With almost 75% of manufacturing companies expecting servitization to dominate the future, manufacturers know they need to go beyond the physical products and offer more to customers. This holds particularly true in the devices market, with almost all brands offering similar product features at a specific price point.

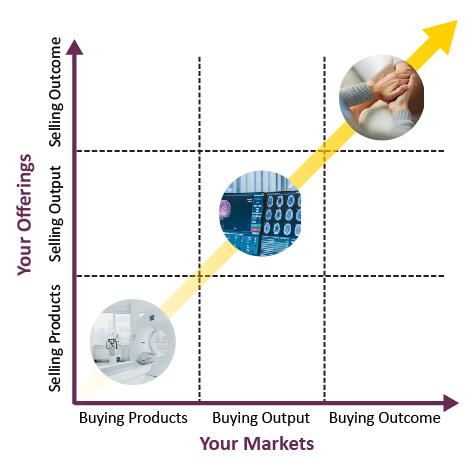

Today, thanks to rapidly changing technologies, OEMs/ODMs are in a race to launch products and features before they get obsolete. They also need to focus on traversing the continuum from selling devices to selling outcomes, seamlessly and successfully.

Overcoming the new normal in Device Engineering:

With subscription models radically influencing consumption patterns, OEMs/ODMs across industry segments are steadily moving away from one-time transactions to building loyal, long-term relationships with customers, governed by continuous personalized interactions.

Service-based business model the norm today:

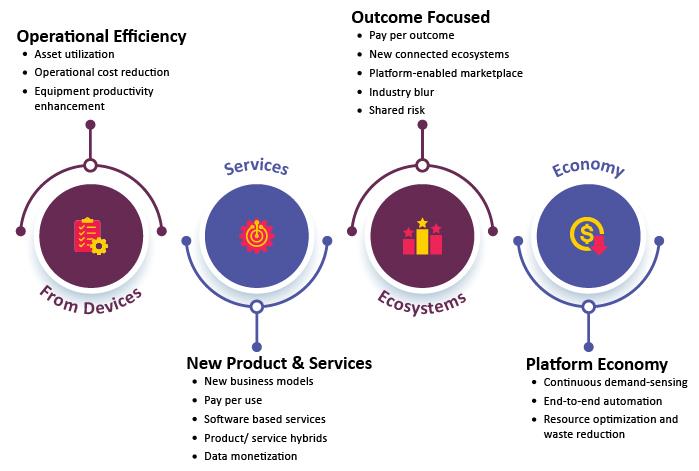

According to the Subscription Economy Index, in 2020, companies that moved towards a subscription-based business model grew six times faster than traditional businesses. Be it B2B or B2C, customers are now looking for wider product choices, greater customization, reliability and product sustainability & upgradability. Companies are rapidly shifting towards connected products and services and transforming from a product economy to a service economy. To manage this shift, companies must also restructure their value chain as given below:

Device as a service/ outcome enabler:

The idea of selling products along with associated services-as-a-solution is not new. It was pioneered by Rolls Royce way back in 1962 when they offered power-by-the-hour for jet engine maintenance management. This meant that airlines no longer had to buy, operate, or maintain engines, nor did they have to trained personnel on repairs or purchase and store spare parts. Instead, if an engine needed servicing, Rolls Royce would take care of it.

In the Medical devices segment, Philips Healthcare moved from selling MRI scanners to selling the scans itself and are now even looking to selling diagnoses based on the scans.

Yet another prominent example of a manufacturing company successfully evolving into a service-driven entity is Xerox. A brand originally known for photocopiers, Xerox diversified into document publishing and production services, document management and business process outsourcing.

Post-sale service and support have become so important that 63% manufacturers say service departments now play a strategic role in their business and 66% of them see it as a revenue generator. According to a McKinsey report, as compared to new product sales margins of ~10%, aftermarket service margin averages 25%.

Devices are rapidly becoming a commodity, not just in the smartphone, telecom or media market, but across industry verticals. Even in the heavy industrial or manufacturing sectors, where customers can “rent” or gain access to machinery and industrial equipment for a recurring fee, even their customer-driven models that engage more with customers’ operations is rapidly gaining momentum.

Global Silicon Shortage:

One of the major challenges that device manufacturers are facing, is the global silicon/chip shortage that has adversely affected almost all the sectors. According to a report by consulting firm AlixPartners, in 2021, the automobile industry lost almost $210 billion in revenue due to the lack of computer chips. To counter this, companies are being forced to adopt short, mid and long term strategies.

Read our PoV on the global silicon crisis.

Processor Architectures Undergoing Transformation:

With several market leaders shifting from their erstwhile strongholds, the fundamental device architectures are also undergoing a radical transformation. For e.g. ARM, which was initially into power optimized segments is now entering into the high performance computing space. RISC-V has now entered the IoT space further disrupting the landscape.

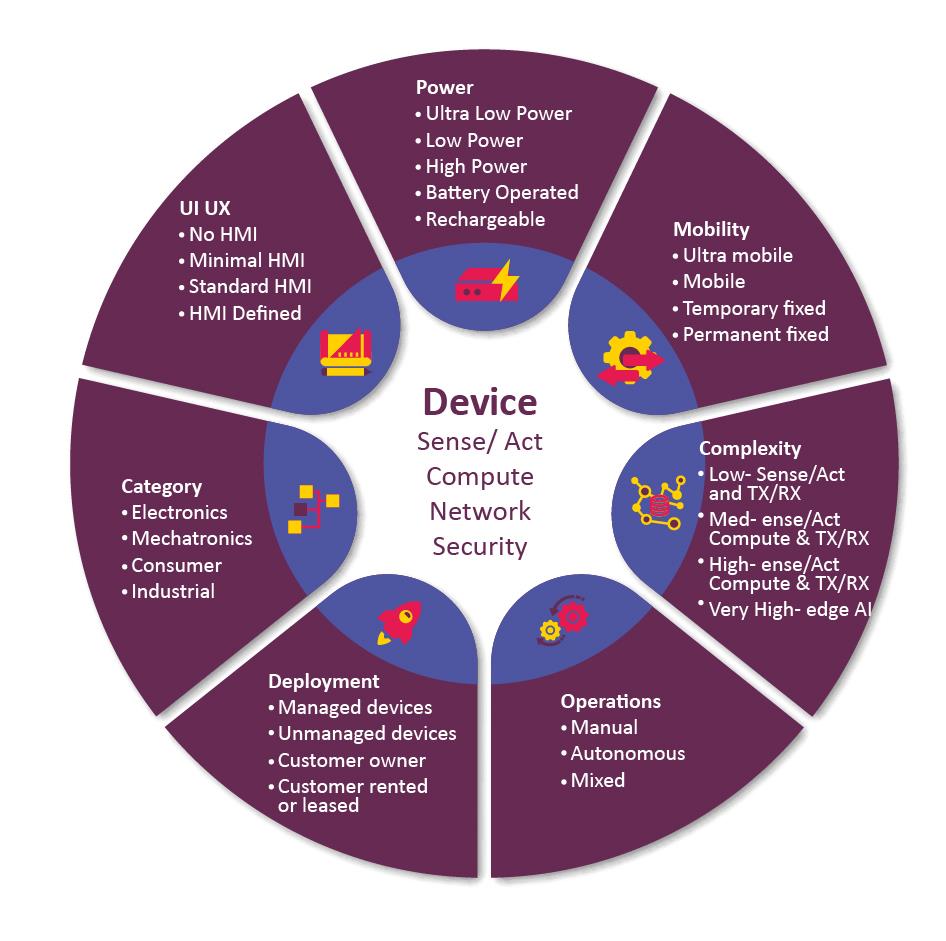

The modern device landscape has become increasingly complex with several dimensions. The illustration given below provides an overview:

Creating the device ecosystem of the future

Quest Global provides end-to-end device engineering and development services that allows customers to accelerate goto-market time, reduce cost and reimagine the business model to make it more sustainable and future-ready.

Our capabilities include:

While most device manufacturing companies understand the urgent need to pivot to a servitization model, the technologies underpinning such a model are either very new or still emerging.

For 25 years, Quest Global has strived to be the most trusted partner for the world’s hardest engineering problems.

We bring deep industry knowledge and digital expertise to deliver E2E global product engineering services. We bring together technologies and industries alongside the contributions of diverse individuals and their areas of expertise to solve problems better, faster. This multi-dimensional approach enables us to solve the most important and large-scale challenges across the Aerospace & Defense, Automotive, Energy, Hi-Tech, Healthcare, Medical Devices, Rail and Semiconductor industries.

References

https://insight.averna.com/en/resources/blog/challenges-facing-medical-device-oems-in-a-changing-market

https://devops .com/4-challenges-oems-face-when-implementing-new-technology/

https://www.wipro.com/process-and-industrial-manufacturing/servitization-the-next-wave-of-growth-for-manufacturing/

https://www.hso.com/innovation/3-reasons-to-add-servitization-in-ma nufacturing/

https://www.paconsulting.com/insights/2017/servitization/

https://www.accenture.com/us-en/blogs/industry-digitization/servitization-as-a-product-strategy

https://tele2iot.com/article/servitization-moving-from-products-to-services-with-iot/

https://www.zdnet.com/article/the-global-chip-shortage-is-still-causing-big-problems-for-car-makers/

https://www.emeraldgrouppublishing.com/opinion-and-blog/what-servitization-manufacturing-a-quickintroduction